Bitget UEX Daily Triumph’s tariff threat escalated and the US stock collapsed; gold and silver prices reached record highs; and the Fed’s chairmanship is being finalized (21 January 2026)

I. Hot spots

Federal Reserve Developments

Trump accelerated the finalization of the Fed's successor and Powell attended the Supreme Court hearing

Federal Reserve Chairman Powell will appear today before the Supreme Court in the Lisa Cook case, which concerns the survival of the Fed's independence. - United States Secretary-General Becent revealed that Trump had reduced his successor to Powell to four candidates, to be announced the following week at the earliest, including candidates Kevin Hasset and Kevin Walsh; - The Swiss Bank report warns that the White House may open the door to the removal of Federal Reserve officials by law if a court decision is unfavourable。

Market impact: This increases the policy uncertainty of the Federal Reserve or further weakens dollar confidence and boosts the demand for risk-averse assets。

Major international commodities

Geo-trade frictions are heating up, and gold and silver are on record

The Trump tariff threat triggered a high level of risk avoidance, and spot gold and silver prices soared their record. - Gold rose by more than 2 per cent, touching $4766/ounces; - silver rose by more than 1 per cent, up to $95.9/ounces; - Bridgewater Foundation Dario warned of the risk of “capital war”, considering gold as a key hedge tool。

Market impacts: Trade wars worry about superbing and weakening the dollar, increasing the attractiveness of precious metals as risk-averse assets or supporting short-term price hikes, but beware of demand constraints from the global economic slowdown。

Macroeconomic policy

The European Union is being pressured by the Trump tariff, and the United States economy is growing at an optimistic pace, but it is not

TRUMP REITERATED THAT IF TARIFFS WERE RESTRICTED, ALTERNATIVE MEANS SUCH AS LICENSING WOULD BE USED AGAINST THE EUROPEAN UNION AND WOULD NOT PRECLUDE THE ACQUISITION OF GREENLAND BY FORCE. - EUROPEAN PARLIAMENT FREEZES THE APPROVAL OF THE US-EUROPE TRADE AGREEMENT IN RESPONSE TO THE 10 PER CENT TARIFF THREAT FROM TRIPP; - US MINISTER OF COMMERCE LUTNIK PREDICTS A 5 PER CENT INCREASE IN GDP IN THE FIRST QUARTER, WITH A 6 PER CENT REDUCTION IN INTEREST RATES, BUT WARNS THE EU NOT TO RETALIATE; - ADP DATA SHOW THAT THE AVERAGE NUMBER OF NEW JOBS PER WEEK HAS SLOWED TO 8,000, INDICATING A FALL IN RECRUITMENT TEMPO。

Market impact: Tariff escalation or renewed global trade wars, slowing stock markets and widening economic uncertainty, but interest-rate reductions are expected to buffer some of the negative shocks。

Market revisiting

- Gold spot: 1.31% +; up-to-date record, risk-averse-dominated

- Cash in silver(b) high-level concussion, risk avoidance & industrial demand support

- WIT CRUDE OIL• Small decline of 0.91 per cent; growth boosted demand in China, but trade friction restrictions increased

- United States dollar index:A small decline of 0.04 per cent; the tariff threat triggered the outflow of funds to avoid risk

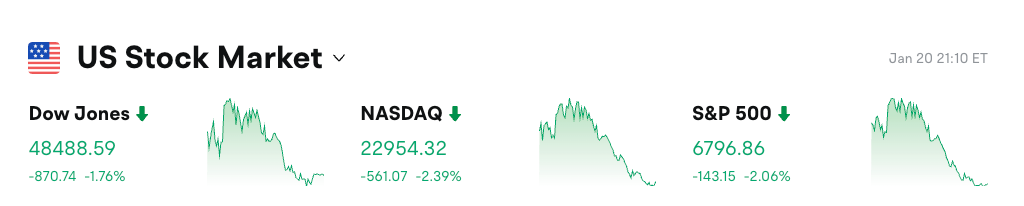

United States equity index performance

- Finger: 1.76% drop + highest single-day drop of almost March, dominated by trade concerns

- Pump 500: Decline 2.06% + Worst performance since October of last year, technology block drag

- Nut finger: 2.39% down + technology unit crashes and geo-risks increase for sale

Technology giant dynamics

- Young Wai DaDecline of 4.38 per cent and escalation of trade battles against demand for chips

- TeslaDecline of 4.17 per cent and increased supply chain disruption concerns

- AppleDecline 3.46 per cent and increased exposure to European markets

- Amazon: down by 3.40%, global trade friction affects electrician logistics

- GoogleDecline 2.42%, advertising is affected by economic uncertainty

- Meta: down by 2.60 per cent and expected increase in growth of users

- MicrosoftOverall, the collapse of the seven giants, caused by the threat of a Trump tariff, led to a global trade war panic, a high sensitivity of the science and technology sectors, and a marked short-term containment。

Plank Instant Observation

Precious metal platesIt's about 6%

- Representative unit: Quinros gold, 8.62 per cent increase

- Drivers: geo-stretching and the weakening of the United States dollar boosted risk-averse demand, and the gold, silver and silver innovation advanced mining unit was active

Encryption concept panelDown by about 7%

- Representation unit: Coinbase, down 5.57 per cent

- Driver: Bitcoin dropped $90,000, lost $3,000 to the Taifung and risk assets sold in waves

III. Depth interpretation

Nafi - performance in the fourth quarter exceeded expectations but outlook was weak

Summary of eventsThe fourth quarter of Nai Fei received $12.05 billion, or $11.97 billion more than estimated; the proceeds per share were $0.56, or $0.43 more than during the same period in the previous year; and the free cash flow was $1.87 billion, or $1.46 billion more than anticipated. However, the company expects to earn $50.7-51.7 billion in 2026, slightly below the $50.96 billion estimate; the $3.91 billion profit from operating in the first quarter, and $0.76 per share, falls short of market expectations. The stock price fell by over 5 per cent. In addition, Nai Fei revised the $72 billion buyout programme explored for the Warner brothers from cash plus equities to full cash to accelerate shareholder voting。

Market interpretation: Goldman Sachs analysts see performance as showing strong growth in subscriptions, but slow expansion in advertising; Morgan Stanley points out that weak outlook reflects increased competition and higher content costs。

Investment revelationShort-term equity prices or acceptances are subject to downward pressure and long-term attention is paid to opportunities for integration in media mergers and acquisitions。

2. In Weeda - Trade friction exacerbates chip demand concerns

Summary of events: THE SHARE PRICE IN WEIDA FELL BY 4.38 PER CENT, AND THE ENTIRE SEMICONDUCTOR PLATE FELL AS A RESULT OF THE TRUMP TARIFF THREAT. THE COMPANY HAS NO MAJOR ANNOUNCEMENTS IN THE RECENT PAST, BUT ITS SUPPLY CHAIN IS HIGHLY DEPENDENT ON GLOBAL TRADE STABILITY AS THE HEAD OF THE AI CHIP. MARKETS ARE CONCERNED THAT THE EU RETALIATORY MEASURES COULD DISRUPT THE EXPANSION OF EUROPEAN MARKETS AND INDIRECTLY AFFECT ASIAN SUPPLY CHAINS。

Market interpretation: BERNSTEIN ANALYST WARNED THAT THE ESCALATION IN TRADE WARFARE WOULD RAISE THE COST OF CHIPS; THE BANK BELIEVES THAT SHORT-TERM FLUCTUATIONS ARE HIGH, BUT THE DEMAND FOR AI IS STRONG IN THE LONG TERM。

Investment revelation: To wait and see in a climate of risk, low-level layouts may be considered once geo-risks are eased。

Tesla - Increased risk of supply chain disruption

Summary of eventsThe Tesla stock price fell by 4.17 per cent, and the technology stock market continued. There are no new companies, but the European market is high, and the Trump tariff threat to the EU has a direct impact on exports and spare parts purchases. Model Y sales have been strong recently, but global trade uncertainty has increased。

Market interpretation: Citi-Analysts point to tariffs or higher prices for European sales, affecting demand; Barclay believes that Cybertruck production can be partially hedged。

Investment revelation: Increased short-term volatility, with attention to new energy policy support as a buffer。

4. Alibaba - The collapse of the medium-sized stock was hampered by the United States share

Summary of events: 1.82 per cent drop in Ali Baba and 1.45 per cent overall decline in the Nazdaq China Golden Dragon Index. There is no corporate news, but the US stock has fallen sharply and trade war concerns have spread to the medium-size stock. The Aribaba electrician is sound but sensitive to cross-border trade。

Market interpretation: Morgan Chase analysts see geo-stressed short-term suppression of valuation; Goldman Sachs sees the potential for cloud business growth。

Investment revelation: This can increase when relations between China and the United States are stable and it is now appropriate to control the position。

IV. Today ' s market calendar

Data release schedules

The big news

- Trump DavosWednesday - Focusing on Greenland negotiations and tariff policy

- Powell's at the Supreme Court hearing: Wednesday - Focus the Fed Independence Debate

- Meeting of senior officials of the Davos Forum: All day long - progress of US-Europe trade agreements

bitget institute view:

The US share was hit hard by the Trump tariff threat, with a 500-storey maximum decline and a fall in the technology plate; precious metals with a new record, driven by hedge demand and the weakening of the US dollar; the bridge's Dario view of gold as the preferred “capital war”; crude oil to boost China's growth, but trade war risk limits increased; and a balanced allocation was recommended。

DISCLAIMER: THE ABOVE IS COLLATED BY AI, MANUALLY ISSUED ONLY FOR VALIDATION AND IS NOT RECOMMENDED FOR INVESTMENT。